The India–UK Free Trade Agreement (FTA), signed on 24 July 2025, is expected to significantly increase bilateral trade in the gem and jewellery sector by removing import tariffs on nearly all Indian exports to the UK.

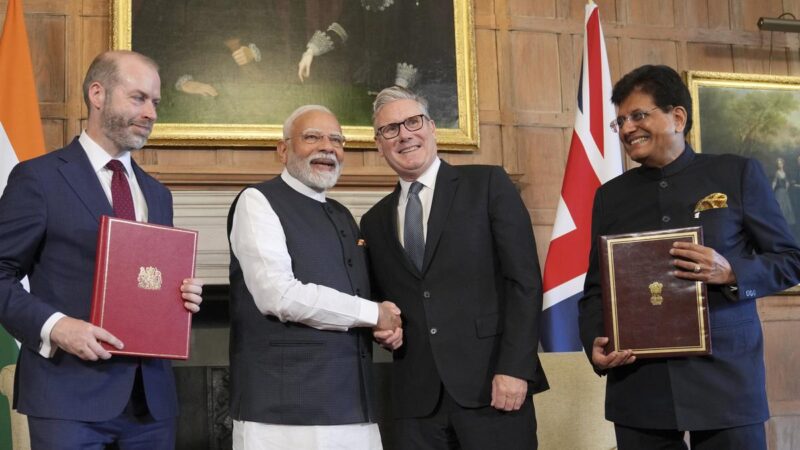

The agreement, signed at Chequers by UK Prime Minister Sir Keir Starmer and Indian Prime Minister Shri Narendra Modi, grants zero-duty access to 99% of Indian exports. Jewellery products expected to benefit include plain gold and gemstone-studded items.

Tariff Removal and Trade Projections

In 2024, gem and jewellery trade between the two countries totalled $3.6 billion—comprising $941 million in exports from India to the UK and $2.7 billion in UK imports. With tariff barriers removed, Indian jewellery exports to the UK are forecast to increase to $2.5 billion, with total bilateral trade in the category projected to reach $6 billion within two years.

Official Commentary

Prime Minister Narendra Modi stated the agreement “provides better market access for Indian textiles, footwear, gems and jewellery, and engineering goods in the UK market.”

Union Minister for Commerce and Industry Piyush Goyal said the FTA “unlocks tariff-free access on 99% of Indian exports to the UK, covering nearly 100% of trade value — including labour-intensive sectors.”

Context: Shifting Global Trade Conditions

The India–UK agreement comes at a time when international jewellery trade is being shaped by evolving tariff frameworks. While this FTA opens a tariff-free corridor between a major production centre and a key consumer market, other markets are seeing increased trade barriers.

Recent changes to U.S. trade policy have introduced higher tariffs on jewellery imports from countries such as India, Thailand and China. These measures have impacted sourcing costs and prompted shifts in supply chain planning for companies operating globally.

In this context, the India–UK agreement offers an alternative route for trade expansion at a time when businesses in the sector are assessing market access and competitiveness in response to differing tariff regimes.

Implications for the Jewellery Trade

The elimination of import duties on Indian jewellery is likely to affect pricing structures and sourcing strategies in the UK. With reduced costs at entry, Indian-made goods may become more competitive, particularly in categories such as gold and gemstone jewellery.

Jewellery businesses importing into or exporting to the UK are advised to review the operational implications of the FTA, including customs procedures, documentation requirements and long-term pricing strategies. As the global trade environment continues to evolve, access to preferential agreements such as this may play an increasingly important role in market positioning and supply chain planning.