Watches of Switzerland Group (WoSG) has announced the commencement of a share buyback programme worth up to £25 million. The buyback, conducted in partnership with Barclays Bank PLC, will reduce the number of shares in circulation.

The move follows the group’s December 2024 refinancing, which provided an additional £50 million in liquidity headroom, bringing the total available facility to £150 million. WoSG stated that its investment strategy, including showroom upgrades, new projects, and acquisitions, remains unchanged.

Strategic Approach to Capital Allocation

In a statement to the London Stock Exchange, WoSG reiterated its approach to capital allocation, prioritising investment in business growth before returning surplus funds to shareholders.

The company has not issued a dividend and continues to prioritise reinvestment. The buyback is a separate measure to return capital to shareholders.

Implementation and Timeline

Under the agreement with Barclays, the bank will act as a riskless principal to purchase up to 23,957,029 ordinary shares on behalf of WoSG. These transactions will be carried out within regulatory frameworks, including the Market Abuse Regulation and the Financial Conduct Authority’s Listing Rules.

The buyback programme commenced immediately and will conclude no later than either WoSG’s next annual general meeting or 3 December 2025. The company has committed to announcing each market repurchase by 7:30 a.m. on the business day following the transaction. Purchased shares will be cancelled, reducing overall share capital.

Market Reaction and Industry Context

Following the announcement, WoSG shares experienced an initial rise, reaching 485p before settling at 462p—a 2.44% increase from the previous close. As of Monday morning, shares had risen further, reaching 473.40p, reflecting a 4.97% increase.

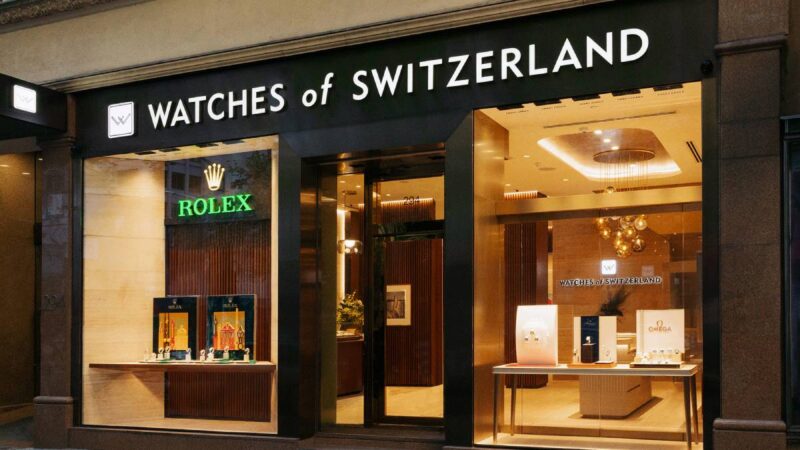

This coincides with the opening of WoSG’s Rolex showroom on Bond Street, the largest in Europe. The showroom opens as Rolex expands its retail presence through its acquisition of Bucherer, a key competitor in the UK and US markets.